Your First Blankly Algorithm

Overview

Let's analyze RSI (Relative Strength Index). It is a common oscillator that is used to indicate whether or not an asset is overbought or oversold by analyzing the average price gains and losses for a given time period.

Want to see what you'll make by the end of this? Check this out

The Buy/Sell Condition

The RSI typically has two bounds set: an upper bound of 70 and a lower bound of 30 (see Investopedia). Specifically, when the asset hits below 30, then we want to buy in, and when the asset hits above 70, we want to sell.

Setting Up Your Environment with Blankly

To get up and running, all we have to do is install blankly and initialize our directory.

Installation

$ pip install blankly

Linking with Blankly Slate (Platform)

If you're using the platform (there's a free plan), then you'll get more access to backtest metrics, results, visualizations, and the ability to easily deploy live. We'll easily login here.

$ blankly login

Initializing Directory

Now, all we need to do is initialize our directory and follow the prompts to get all set up (if you're using Blankly Slate, feel free to create a new model here called "RSI Bots")

$ blankly init

Adding Alpaca Keys

We're going to use Alpaca for this tutorial, but feel free to use whatever you'd like. The video below links how to set up Alpaca keys with Blankly

Implementing in Blankly

The blankly.Strategy Object

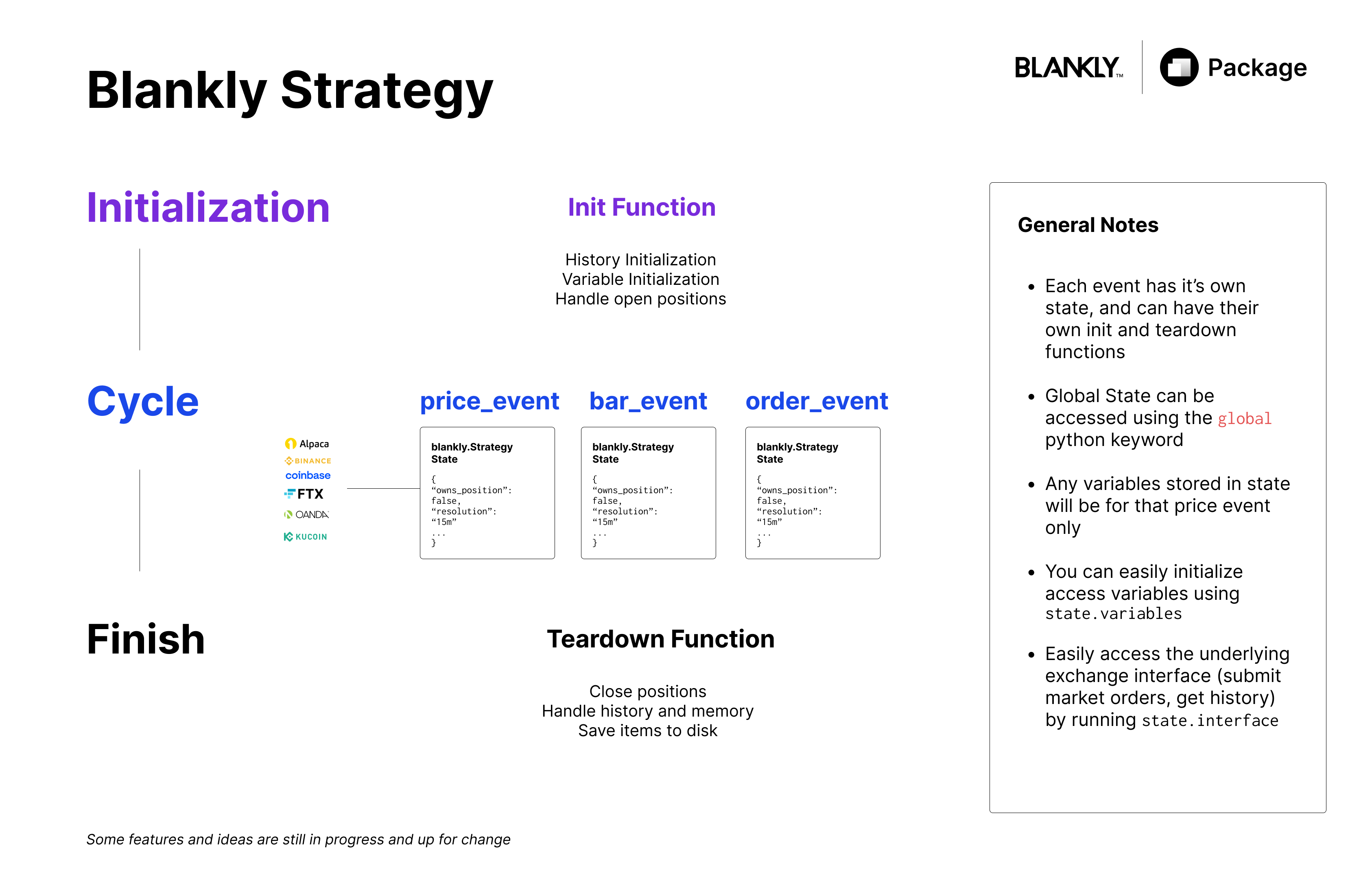

The strategy class is the heart of the Blankly development framework. The goal when developing this class was to create something that could seamlessly integrate with the powerful user-objects that Blankly provides, while also giving an experience that barely goes beyond basic python. This means that functions can be asynchronous and multithreaded without the user ever noticing, while taking advantage of highly integrated exchange interfaces to make model development incredibly clean & simple.

Similar to many modern packages that follow more of a functional and declarative format such as Keras, we wanted to model our Strategy class so that anyone can easily integrate their models and custom price events.

More details, check out the Blankly Strategy Docs

Strategies created using the class can be instantly backtested, paper traded, sandbox tested, and deployed by only changing a single line.

Strategies can have as many price events and combinations as you'd like. You're able to run a single price event on multiple resolutions and symbols and or run many-to-many.

Setting Up Our Python File

blankly init provides us a bot.py but we're going to utilize our own and call it rsi_bot.py

Boilerplate Code

We will be implementing this strategy using Blankly.Strategy that allows for a quick and easy way of building out our RSI strategy. We'll also be utilizing blankly.indicators to quickly implement the RSI calculations.

Create Strategy

from blankly import Strategy, StrategyState, Interface

from blankly import Alpaca

from blankly.indicators import rsi

def init(symbol, state: StrategyState):

# run on a new price event to initialize variables

pass

def price_event(price, symbol, state: StrategyState):

# we'll come back to this soon

pass

alpaca = Alpaca()

s = Strategy(alpaca)

s.add_price_event(price_event, 'MSFT', resolution='15m', init=init)

s.start()

Initializing Variables and History

In order to speed things up, we should make one call to get the historical data that we need and append data as new prices come in. We can actually easily do this on initialization and make sure the proper data is passed in to the proper price events:

def init(symbol, state: blankly.StrategyState):

# Download price data to give context to the algo

# This gets the past 150 data points as a deque to reduce memory usage

state.variables['history'] = state.interface.history(symbol, to=150, return_as='deque')['close']

state.variables['owns_position'] = False

Implementing the Price Event

Now that we have the code set up, let's take a deep dive into how to implement this price event.

First, as we recall, we want to buy an entity when the RSI is under 30 and sell when the RSI is greater than 70, we will use a period of 14 (the typical setup) This is a very simple conditional statement.

def price_event(price, symbol, state: StrategyState):

""" This function will give an updated price every 15 minutes from our definition below """

state.variables['history'].append(price)

rsi = blankly.indicators.rsi(state.variables['history'])

if rsi[-1] < 30 and not state.variables['owns_position']:

buy = int(state.interface.cash / price) # calculate number of shares from cash

state.interface.market_order(symbol, side='buy', size=buy)

state.variables['owns_position'] = True

elif rsi[-1] > 70 and state.variables['owns_position']:

curr_value = int(state.interface.account[state.base_asset].available)

state.interface.market_order(symbol, side='sell', size=curr_value)

state.variables['owns_position'] = False

Adding it All Together

Now that we've gotten everything, let's bring it all together. Congrats! In just 20 lines of code, you've built a fully functional, backtestable trading algorithm.

import blankly

def price_event(price, symbol, state: blankly.StrategyState):

""" This function will give an updated price every 15 seconds from our definition below """

state.variables['history'].append(price) # appends to the deque of historical prices

rsi = blankly.indicators.rsi(state.variables['history'])

if rsi[-1] < 30 and not state.variables['owns_position']:

buy = int(state.interface.cash / price)

state.interface.market_order(symbol, side='buy', size=buy)

state.variables['owns_position'] = True

elif rsi[-1] > 70 and state.variables['owns_position']:

curr_value = int(state.interface.account[state.base_asset].available)

state.interface.market_order(symbol, side='sell', size=curr_value)

state.variables['owns_position'] = False

def init(symbol, state: blankly.StrategyState):

# Download price data to give context to the algo

state.variables['history'] = state.interface.history(symbol, to=150, return_as='deque')['close']

state.variables['owns_position'] = False

if __name__ == "__main__":

# Authenticate alpaca strategy

exchange = blankly.Alpaca()

# Use our strategy helper on alpaca

strategy = blankly.Strategy(exchange)

# Run the price event function every time we check for a new price - by default that is 15 seconds

strategy.add_price_event(price_event, symbol='MSFT', resolution='15m', init=init)

# Start the strategy. This will begin each of the price event ticks

# strategy.start()

# Or backtest using this

results = strategy.backtest(to='1y', initial_values={'USD': 10000})

print(results)

Now just run

$ python rsi_bot.py

If you're using Blankly Slate, your backtest should now be visualized in the platform!

You'll also get output in your terminal!

Awesome! We just successfully ran our first model

Deploying It

If you want to test it out, let's put it into a live paper trading environment using Blankly Slate (if you're following with Blankly Slate).

Now all you have to do is run

$ blankly deploy

See the final result that you'll actually get here